Predicting Mortgage Risk with Machine Learning on AWS

The company is recognized as one of the largest providers of specialty insurance and loan servicing solutions in the U.S. mortgage industry. With a team of licensed adjusters and technology-driven processes, the organization supports investors by simplifying claims management and property risk analysis.

The company is recognized as one of the largest providers of specialty insurance and loan servicing solutions in the U.S. mortgage industry. With a team of licensed adjusters and technology-driven processes, the organization supports investors by simplifying claims management and property risk analysis.

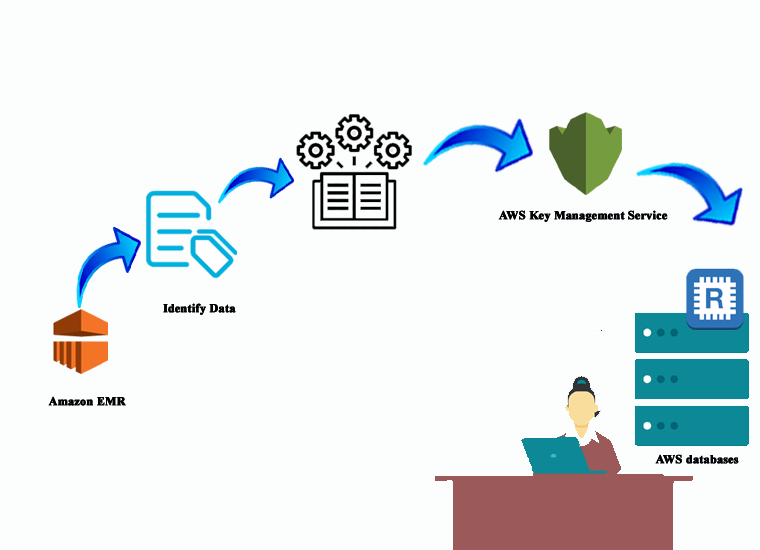

Data Ingestion & Security Setup

Centizen kicked off the project by establishing a secure data pipeline. Client data from internal systems was anonymized and transferred to Amazon S3. To ensure data security and compliance:

- AWS Key Management Service (KMS) was used to manage encryption keys.

- IAM policies were configured for role-based access.

- AWS CloudTrail was enabled for activity logging and traceability.

Data Cleaning & Feature Extraction

Using Amazon EMR with Apache Spark, Centizen processed raw datasets to eliminate noise, correct inconsistencies, and standardize inputs. During this phase:

- Features related to property characteristics, geographic location, and peril types were extracted.

- A structured training dataset was created to support accurate model development.

Model Development & Training

Centizen used Amazon SageMaker to build and train nine predictive models focusing on:

- Claim probability

- Recovery estimation

- Peril classification

The team used SageMaker’s automatic model tuning and SageMaker Clarify to detect bias, validate predictions, and optimize model performance.

Workflow Automation & Portfolio Scoring

An end-to-end portfolio scoring pipeline was implemented:

- New mortgage portfolios uploaded to S3 triggered an automated pipeline.

- EMR prepared the data and appended the required attributes.

- SageMaker inference endpoints applied predictive models.

- Results were aggregated into actionable reports for investor review.

The client gained the ability to process large mortgage portfolios with greater speed and accuracy. Centizen’s machine learning models delivered high-precision predictions that improved operational workflows, eliminated manual bottlenecks, and supported data-driven investor decisions. The end-to-end pipeline ensured secure data handling, while automation enabled scale without compromising compliance or quality.

90 %

accuracy in predicting damage, claims, and recovery.

70%

reduction in manual data processing time.

100%

automated portfolio scoring and risk reporting.

With scalable analytics in place, the client can now analyze thousands of properties in real time. Secure AWS tools like KMS, IAM, and CloudTrail provided full compliance and traceability. These outcomes not only improved investor confidence but also positioned the client as a technology-forward leader in the mortgage insurance industry, ready to scale with growing demand.

Within 8 weeks, the client partnered with Centizen to move from manual data handling to scalable, AI-driven automation, enabling confident, data-backed decisions across thousands of properties.

Services

Send Us Email

contact@centizen.com

Centizen

A Leading Staffing, Custom Software and SaaS Product Development company founded in 2003. We offer a wide range of scalable, innovative IT Staffing and Software Development Solutions.

Call Us

India: +91 63807-80156

USA & Canada: +1 (971) 420-1700

Send Us Email

contact@centizen.com

Centizen

A Leading Staffing, Custom Software and SaaS Product Development company founded in 2003. We offer a wide range of scalable, innovative IT Staffing and Software Development Solutions.

Call Us

India: +91 63807-80156

USA & Canada: +1 (971) 420-1700

Send Us Email

contact@centizen.com